Automatic system for loan application consideration process

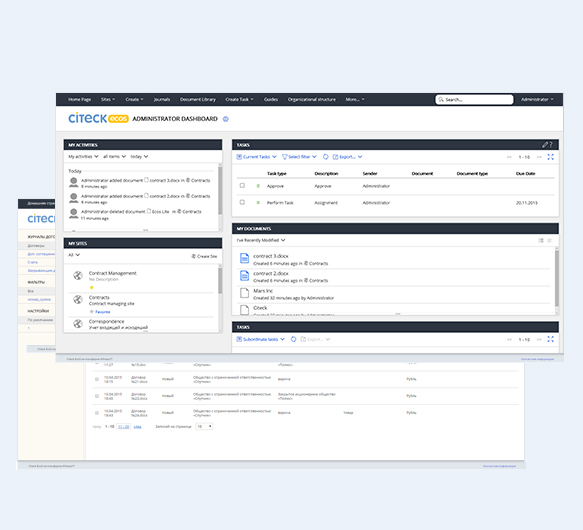

Case management system based on the open source Alfresco ECM platform.

- Reduces the duration of loan application consideration process

- Sets the loan consideration proccess on the flow

Our clients